Paddy Adenuga: A Life Beyond the Billions

Paddy Adenuga’s story defies simple categorization. Born into monumental affluence as the son of Nigerian entrepreneur Mike Adenuga, he might have just as well floated into a life of tranquil comfort.

But from the start, Paddy took the opposite path, the path that would be characterized by discipline, ambition, and ceaseless effort to make his mark.

His journey from a ten-year-old cadet at a military academy to a sharp businessperson and creative screenwriter illustrates a man who never stops striding in the shadow of expectation.

This is not a story of inheritance, but of identity; a lifelong effort to honour his roots while steadfastly writing his name into the world.

Table of Contents

Academic Achievements

Paddy Adenuga’s schooling life appears not so much a typical school report as a strategy session for an unconventional life. In contrast to each conventional timeline, he was not merely a bookish kid; he was in a different league altogether in terms of intelligence. As other kids his age navigated the complications of middle school, a thirteen-year-old Paddy graduated from The Tenney School in Houston.

This was not only an extraordinary feat; it was based on an avowed declaration of intent. He dove headfirst into college work right away, taking BUSINESS ADMINISTRATION at UMass, Boston, that very year.

While his contemporaries were still picking up their high school diplomas, Paddy was already at Northeastern and well on his way to a BS in Business Management.

He finished that degree at the tender age of eighteen, an astounding achievement that suggested more than just raw smarts.

That aggressive thrust was the evidence of a deep inner impetus, a wish to condense a lifetime of intellectual discovery into his all-too-brief number of years, always getting ahead of the monumental pressures that had been applied to his name since birth.

Read Also: Mercy Kenneth Biography: Age, Parents, Husband, Net Worth

Family Business Launchpad

Paddy Adenuga’s entry into the family business was natural but never passive. From 2002 to 2006, he was Group Executive Director in his father’s vast conglomerate, a role that placed him amid its most dynamic operations.

He was not just occupying an office but was spearheading the expansion of Globacom, the telecom giant, to move it outside Nigeria into Ghana and the Benin Republic.

Simultaneously, he was intensely involved in planning for Conoil Producing, the group’s bold oil exploration company.

It was a matchless masterclass in African business on a mega level.

Despite the unlimited potential, restlessness kicked in. The Adenuga name most definitely opened all doors, a privilege he was aware of and took advantage of. However, Paddy became increasingly angry with the predestined course.

He needed to create something that had his distinct imprint; he didn’t want to manage a legacy merely. This drive would soon take him outside the cozy confines of the empire.

Entrepreneurial Gambles

Paddy’s ambition soon outgrew the executive suite. In 2006, driven by a need to prove his merit, he moved to London and co-founded Cayne & Cayne, an oil brokerage firm supplying refined petroleum to Nigerian markets.

This was his first true solo venture, a deliberate step into the arena of independent entrepreneurship. A brief return to the family firm as co-CEO from 2009 to 2011 saw him spearhead Conoil’s hostile $1.3 billion takeover bid for Shell’s OML 30 block. Nevertheless, he hunted his legacy.

Read Also: Eniola Ajao’s Bio: Age, Personal Life, Husband, Net Worth

He returned to London in 2012 and established Catalan Corporation, an oil and gas investment advisory firm. Here, he conceived his most daring gamble: a bid for Chevron’s Dutch North Sea assets.

His “Trojan Horse” strategy aimed to use a European foothold to access African oil markets. Crumpling under a $300 million environmental liability and fluctuating oil prices, that complicated deal eventually fell apart, an eye-opening tale he would later recount with refreshing honesty in his article, A Lion in the North Sea.

Although this audacious bust exhibited his hunger for big-money deals, it also produced an understated condemnation that such massive risk could only be taken with the tacit cushion of his family’s enormous fortune.

Constructing Pegasus Capital

The establishment of Pegasus Capital Investments in 2016 was a complete and deliberate career change for Paddy.

Steering resolutely from the oil and gas industry, which lent his family’s wealth its name, he deliberately steered his venture into the food and beverage sector, with investments in the UK and the Netherlands in his sights.

This shift was not just a change of business interest; it was a categorical statement of intention to create a legacy differentiated one, operating in markets and industries not immediately within the Adenuga domain.

Though the connections and resources of his upbringing provided an undeniable starting point, Pegasus is a mature, strategic effort to apply his acquired business acumen in an entirely new arena, forging a professional identity that is unequivocally his own.

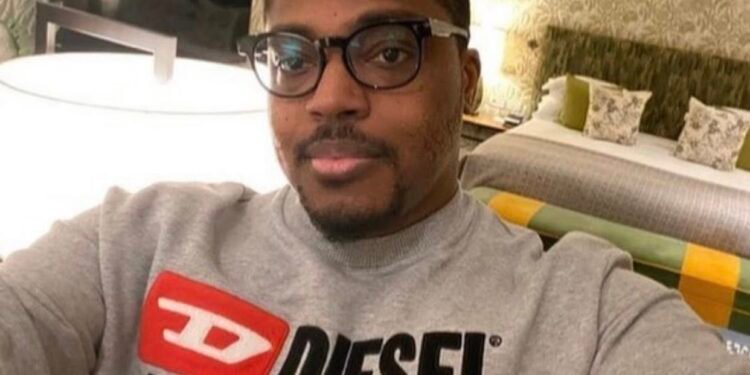

Paddy Adenuga’s Personal Life

Paddy Adenuga’s life is built around honouring his heritage, but his personal life is far from the challenging environment of the boardroom. He lives with his wife, whom he met in secondary school, and their two children in London.

His more reclusive life as a father is far removed from this wholesome family life.

Read Also: Steve Crown’s Biography: Age, Wife, Tribe, Net Worth

His interests betray a polymath. He’s a mythical NFL Buffalo Bills supporter, a member of the international “Bills Mafia.” A sustained creative pastime offsets this enthusiasm for sport; he’s been writing screenplays since he was fifteen and completed his fifth, Waterloo, in 2023.

The discipline he acquired during his childhood at military school is the underlying principle of his daily life, manifested in a dedicated physical routine that involves the trained concentration of Kung Fu and constant regular workouts.

Privilege and Public Scrutiny

Paddy Adenuga’s ambitious but ultimately unsuccessful bid for Chevron’s Dutch assets did more than mark a business setback; it sharply highlighted the dynamics of Nigeria’s “enclave economy.”

In this system, the financial risks taken by a privileged few can often ripple outward, ultimately affecting public resources. When large, elite-backed ventures falter, the consequences frequently extend beyond personal loss, potentially straining banking systems and limiting capital for broader national development.

While Paddy Adenuga actively champions a narrative of self-made success, astute commentators emphasize that his capacity to undertake such high-stakes ventures is rooted in a safety net entirely inaccessible to most.

His ventures operate with a freedom born from unparalleled financial security. His response to such scrutiny has not been defensive but action-oriented, exemplified by a determined 2023 birthday declaration: “One year before 40! Gotta make this one count!” A vow that underscores his relentless drive to validate his efforts on his terms.

Legacy in Motion

In his early forties now, Paddy Adenuga lives in a unique space at the intersection of two influential roles: being a responsible heir and an independent agent innovator.

His company, Pegasus Capital, grows deliberately in the food and beverage sector, a genuine step toward a self-planned career.

Meanwhile, his passion for screenwriting provides an escape into imagination and a personal challenge away from the business domain.

Read Also: Olumo Rock’s History: A Fascinating Journey Through Time

But behind him is always the shadow of his dad, a recent Lifetime Achievement Award, only to bring into sharp relief the size of the dynasty Paddy Adenuga will now be presiding over. His entire life poses an interesting question: Can inherited privilege become actual, practical innovation?

As more pressure is being put on Africa’s richest to contribute to the betterment of society, Paddy’s choices, whether in business, philanthropy, or art, will ultimately determine if an heir can redefine the value of his legacy.